Trust Foundations: Reliable Solutions for Your Construction

Trust Foundations: Reliable Solutions for Your Construction

Blog Article

Strengthen Your Legacy With Professional Trust Structure Solutions

In the realm of heritage planning, the relevance of developing a strong structure can not be overstated. Professional count on foundation solutions provide a robust structure that can secure your properties and ensure your wishes are performed precisely as planned. From reducing tax obligation obligations to picking a trustee that can properly manage your affairs, there are essential considerations that require attention. The intricacies entailed in depend on structures demand a strategic strategy that straightens with your lasting goals and worths (trust foundations). As we explore the nuances of trust fund foundation options, we uncover the crucial elements that can fortify your tradition and give an enduring influence for generations ahead.

Benefits of Count On Structure Solutions

Depend on foundation remedies supply a durable structure for protecting assets and guaranteeing long-term financial safety for people and companies alike. Among the primary benefits of trust fund structure remedies is possession defense. By establishing a depend on, individuals can shield their properties from potential risks such as claims, creditors, or unforeseen financial obligations. This defense guarantees that the assets held within the depend on remain safe and can be passed on to future generations according to the individual's wishes.

Furthermore, depend on structure remedies give a critical strategy to estate preparation. Through counts on, individuals can describe just how their properties should be managed and dispersed upon their passing. This not only helps to avoid problems amongst beneficiaries but likewise makes sure that the individual's tradition is managed and handled successfully. Trust funds additionally supply personal privacy advantages, as possessions held within a count on are exempt to probate, which is a public and often prolonged lawful procedure.

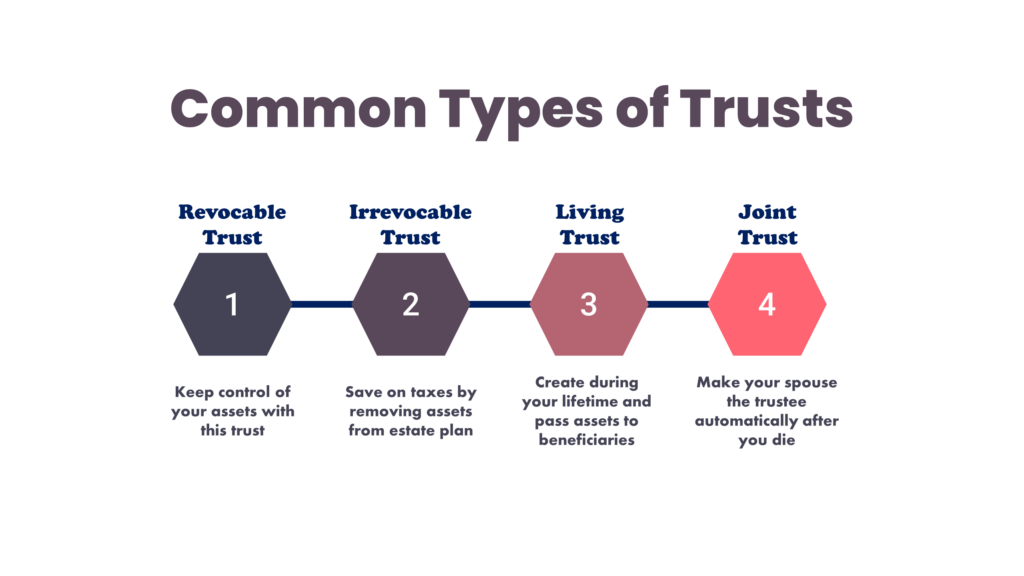

Sorts Of Trust Funds for Legacy Preparation

When considering tradition planning, a crucial facet includes checking out various kinds of legal tools designed to protect and disperse properties effectively. One common sort of count on made use of in heritage preparation is a revocable living trust. This depend on permits individuals to maintain control over their assets throughout their life time while making sure a smooth transition of these possessions to beneficiaries upon their passing away, preventing the probate procedure and offering privacy to the family members.

An additional type is an unalterable depend on, which can not be altered or revoked as soon as developed. This count on offers prospective tax benefits and secures properties from lenders. Charitable counts on are likewise prominent for people seeking to support a cause while keeping a stream of earnings on their own or their beneficiaries. Unique demands counts on are essential for individuals with handicaps to ensure they obtain necessary care and assistance without jeopardizing government advantages.

Recognizing the different types of depends on readily available for heritage planning is essential in establishing a detailed approach that straightens with individual goals and priorities.

Choosing the Right Trustee

In the realm of tradition planning, an important facet that requires mindful factor to consider is the option of an ideal person to accomplish the pivotal role of trustee. Choosing the right trustee is a choice that can significantly impact the effective implementation of a trust fund and the navigate to this website gratification of the grantor's dreams. When choosing a trustee, it is vital to focus on high qualities such as credibility, monetary acumen, integrity, and a dedication to acting in the very best passions of the recipients.

Ideally, the picked trustee ought to have a strong understanding of economic matters, be capable of making audio financial investment decisions, and have the ability to navigate intricate lawful and tax obligation requirements. By very carefully taking into consideration these factors and selecting a trustee that straightens with the worths and purposes of the depend on, you can assist make sure the long-term success and conservation of your legacy.

Tax Ramifications and Advantages

Considering the fiscal landscape surrounding trust structures and estate planning, it is paramount to look into the complex world of tax obligation ramifications and advantages - trust foundations. When developing a count on, recognizing the tax implications is critical for enhancing the benefits and minimizing potential liabilities. Depends on provide different tax obligation advantages depending on their framework and objective, such as lowering estate tax obligations, revenue tax obligations, and gift taxes

One considerable advantage of particular depend on frameworks is the capability to transfer properties to recipients additional info with minimized tax consequences. As an example, irrevocable trusts can get rid of possessions from the grantor's estate, potentially lowering estate tax obligation obligation. In addition, some counts on enable revenue to be dispersed to beneficiaries, that may remain in lower tax obligation brackets, resulting in total tax savings for the household.

However, it is essential to keep in mind that tax regulations are complicated and subject to change, highlighting the necessity of speaking with tax specialists and estate planning specialists to guarantee compliance and make the most of the tax obligation benefits of trust fund foundations. Effectively navigating the tax obligation implications of depends on can cause substantial savings and an extra efficient transfer of riches to future generations.

Actions to Establishing a Depend On

To develop a trust fund successfully, precise focus to detail and adherence to legal procedures are essential. The initial step in establishing a count on is to plainly specify the purpose of the depend on and the properties that will be included. This includes recognizing the recipients who will gain from the depend on and assigning a credible trustee to handle the properties. Next off, it is crucial to select the type of depend on that ideal straightens with your objectives, whether it be a revocable trust, irrevocable depend on, or living depend on.

Verdict

In conclusion, developing a depend on foundation can give many benefits for heritage planning, including asset defense, control over distribution, and tax benefits. By picking the proper sort of count on and trustee, people can secure their assets and guarantee their dreams are performed according to their wishes. Comprehending the tax effects and taking the essential steps to develop a depend on can aid enhance your heritage for future generations.

Report this page